FREELANCE BOOKKEEPING WANTS TO W2 EMPLOYEE FULL

See more information in our article on contract employees vs full time workers.

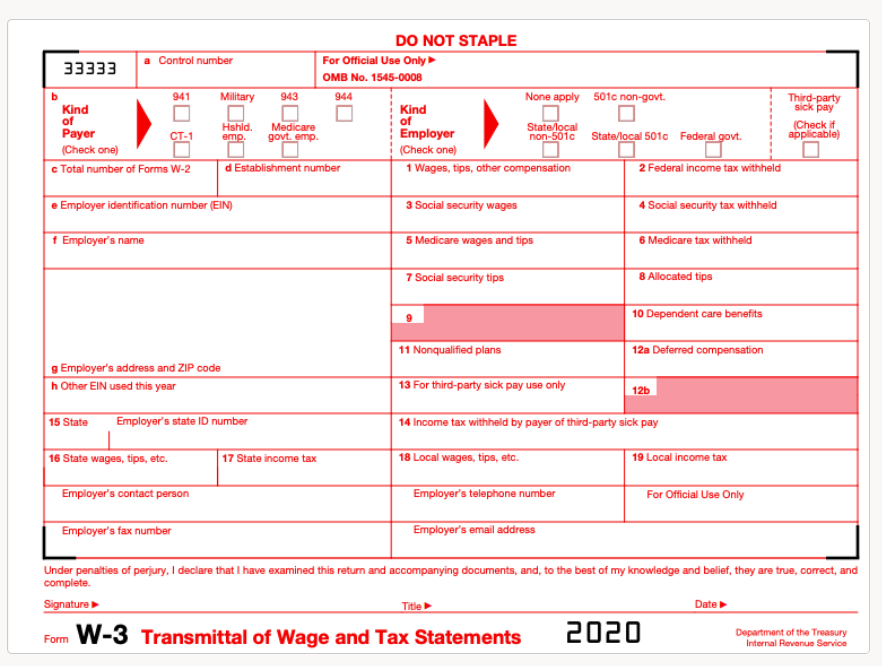

Keep in mind that the agreement between the employer and worker is just one of the factors that determine whether a worker is an actual employee. Many employers let workers know their relationship with the employer at the time they are hired. The specific job requirements provided by the.How much instruction or training the worker.The amount of control employers legally have.However, that is not the only distinction.īoth the IRS and many states have detailed rules thatĬlassify workers as an employee who receives a W-2 or an independent contractor Reported on a W-2, while 1099 employees have income reported on a 1099. One difference is that standard employees have yearly income However, offering some benefits can help your business attain the highest level of talent, particularly in a competitive industry.ĭifferences Between 1099 and Standard Employees These employees manage their own tax planning and often do not expect 1099 employee benefits from their employers. Some states also do notĬonsider 1099 workers actual employees to the company.Ĭommon examples of 1099 workers might include doctors in hospitals, building subcontractors, sales people that work on commission, and different types of freelancers. True employees by the Internal Revenue Service (IRS). Self-employed or operate as independent contractors. The term “1099 employee” usually refers to workers that are If you are considering self-employed health insurance, there are a few factors to consider. While you are not legally required to do so, you do have the option to provide benefits if you choose. If you are an employer that has 1099 employees, you might be wondering whether you should offer health insurance to these workers.

0 kommentar(er)

0 kommentar(er)